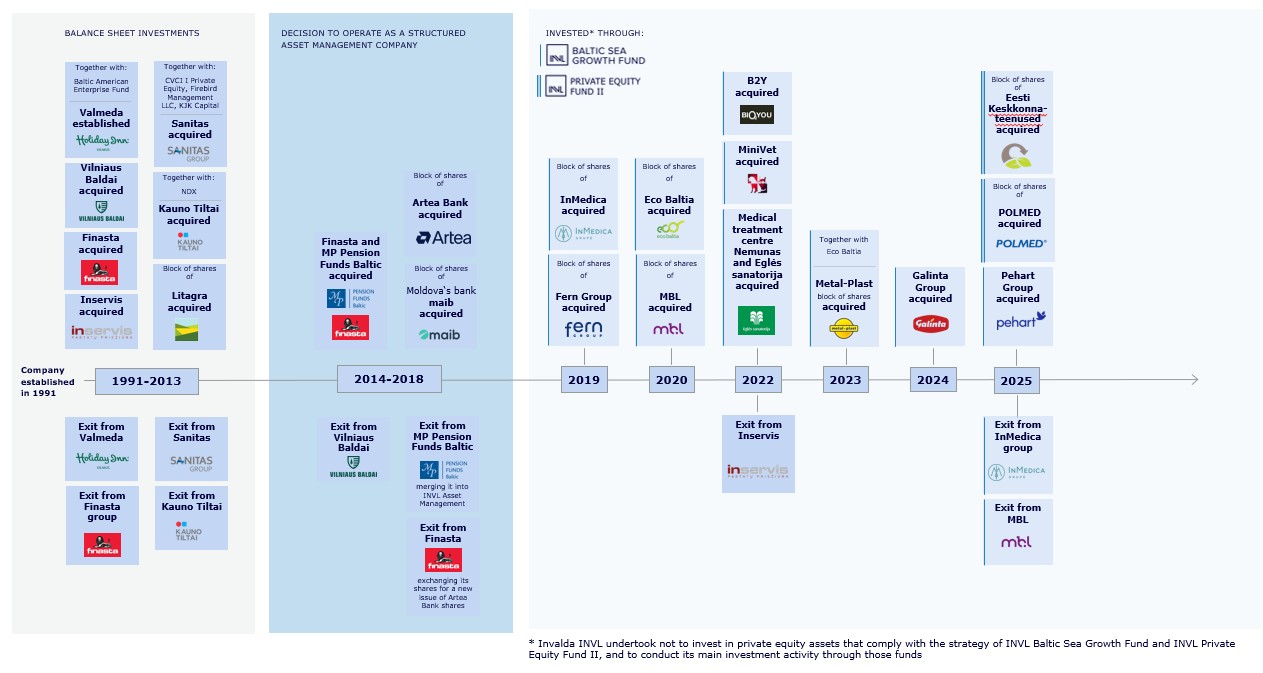

In the business for more than 30 years now, the Invalda INVL group has solid experience managing private equity assets and building market players that are leaders in their respective fields in the Baltic countries and Central and Eastern Europe.

In collaboration with foreign private equity funds and local entrepreneurs, we have completed several dozen acquisitions, company sales and capital-raising transactions.

With one of the most experienced private equity teams in the region, we successfully manage products that vary in size as well as in the investee companies’ region and type of operations. Most capital is invested in the Baltics, but there are also some investments outside the region.

Our private equity investments create value not only through strong returns for investors, but also by driving economic growth in the region and contributing to broader social welfare.

INVL Private Equity Fund II is the largest private equity fund in the Baltics.

- Size: €410 million.

- The fund will build on the strategy of the INVL Baltic Sea Growth Fund, seizing attractive opportunities across the Baltics, Poland, Romania and the broader EU.

Target investments include:

- the size of investment in a company – €10–40 million, with a preferred equity ticket of around €25-30 million;

- majority or significant minority stakes;

- companies with high growth potential and the ability to operate in the face of increasing global competition.

INVL Private Equity Fund II

Our main product is INVL Baltic Sea Growth Fund, the largest private equity fund in the Baltic States with the European Investment Fund (EIF) as the main investor.

- Size: €165 million;

- The fund focuses on investment in the Baltic States and neighbouring regions such as Poland, Scandinavia and Central Europe;

- The fund’s mandate covers investment across the European Union.

Target investments include:

- the size of investment in a company – €10–30 million (with a lower consolidation potential, lower initial investment is also possible);

- majority or significant minority stakes;

- companies with high growth potential and the ability to operate in the face of increasing global competition.

INVL Baltic Sea Growth Fund

Another company in our private equity portfolio is INVL Technology, a closed-end investment company listed on the Nasdaq Stock Exchange.

- Start of operation: 14/07/2016;

- Term: 10 years (+2 years);

- Capitalisation as at 30/06/2025: €44.3 million;

- INVL Technology’s Articles of Association allow the company to invest in European Economic Area, Organisation for Economic Co-operation and Development (OECD) countries and Israel. The portfolio companies implement projects in: Northern and Eastern Europe, Sub-Saharan Africa, and South and Southeast Asia.

Target investments include:

- IT companies catering to large corporations and public-sector clients;

- improvement of the business climate, e-governance, IT services and programming;

- cybersecurity.

INVL Technology

INVL Special Opportunities Fund has indirectly invested in maib, the largest bank in Moldova.

- Fund size: €4.5 million

- Start of operation: 2018, term – 10 years

- Investment in the shares of maib (maib).

- The aim is to transform MAIB into a leader in new standard banking services, focusing on digitization and innovation and strengthening the retail banking segment.

INVL Special Opportunities Fund

+30 YEARS OF EXPERIENCE IN PRIVATE EQUITY MARKET